Dental Plans

Dental benefits are low risk!

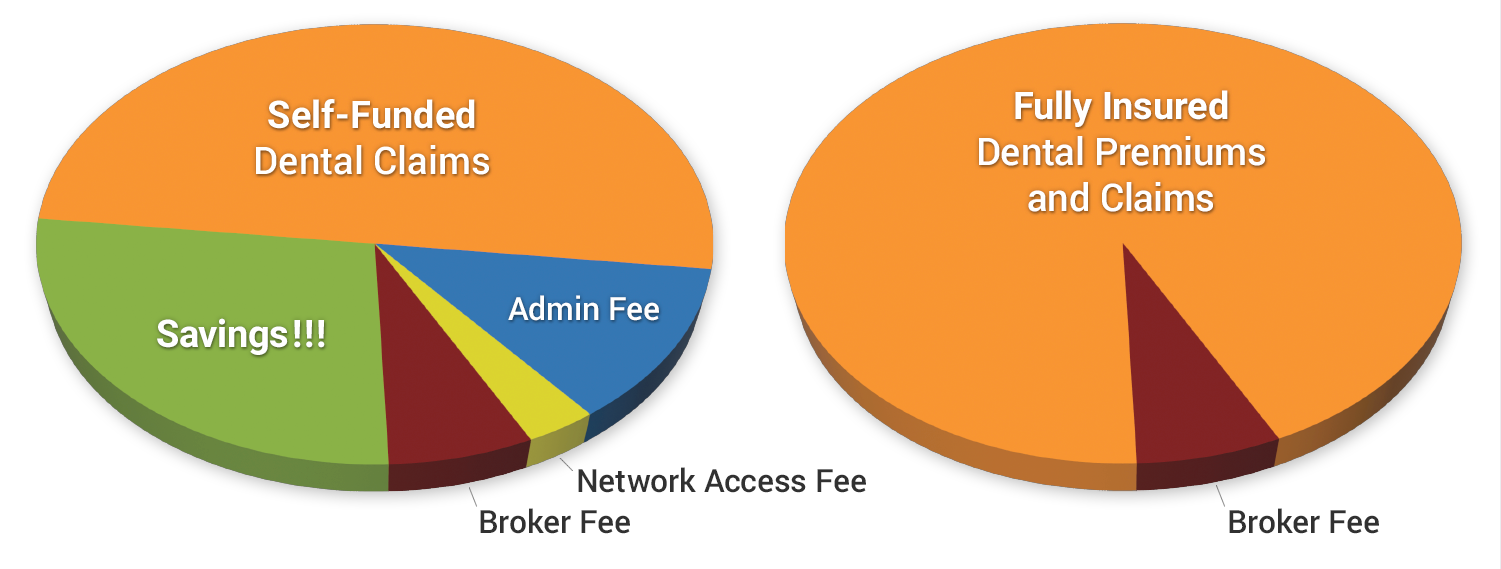

A carrier for excess claim exposure is not required. The liability is low because dental benefits are capped. Understanding that you can remove the need for traditional insurance also removes the excess cost.

Create a reserve!

Without the big insurance companies raking in profits off your dental plan, you will only pay for dental claims as they are incurred plus a fixed administration fee to BAC. You can balance employee contributions with the claim costs to ensure the dental plan remains a non-issue for your budget. BAC provides full financials for your benefit plan (both accrual and cash basis) with the bank account reconciled monthly by our accounting team. You will know where every dollar is spent and how to plan for future years.

Valuable benefit for your employees!

With BAC’s flexibility, you can create dental benefits that meet the unique needs of your workforce. Easy customization leads to higher employee satisfaction and engagement with using their dental benefits. Cover fluoride, layer in orthodontia, customize the deductible… Stop the confusion of jumping from carrier to carrier every few years to offset renewal increases.

Use a large carrier network but get top-notch customer service!

BAC utilizes the Cigna Dental Network so finding an in-network dental provider is easy. Out-of-network claims are paid at 90% of usual and customary charges so members are not penalized, but there is less out of pocket expense to use the network. Add in BAC’s high touch customer service approach and it is a win-win! Members will have direct access to a dedicated dental claim specialist. No more getting lost in the 1-800 waiting game when a question arises.

Working with BAC to integrate dental coverage into our self-funded health plan was one of the easiest benefit decisions we’ve made. Not only was the implementation smooth, but the cost savings were immediate and measurable. By year two, the dental plan had completely paid for itself—saving us significantly compared to our previous fully insured arrangement. We’ve been able to maintain that savings year over year even while enhancing the benefit offering to our employees. The BAC team provided clear guidance, responsive support, and data-driven reporting that helped guide our decision. We truly feel like we have a partner, not just a vendor.